Projects

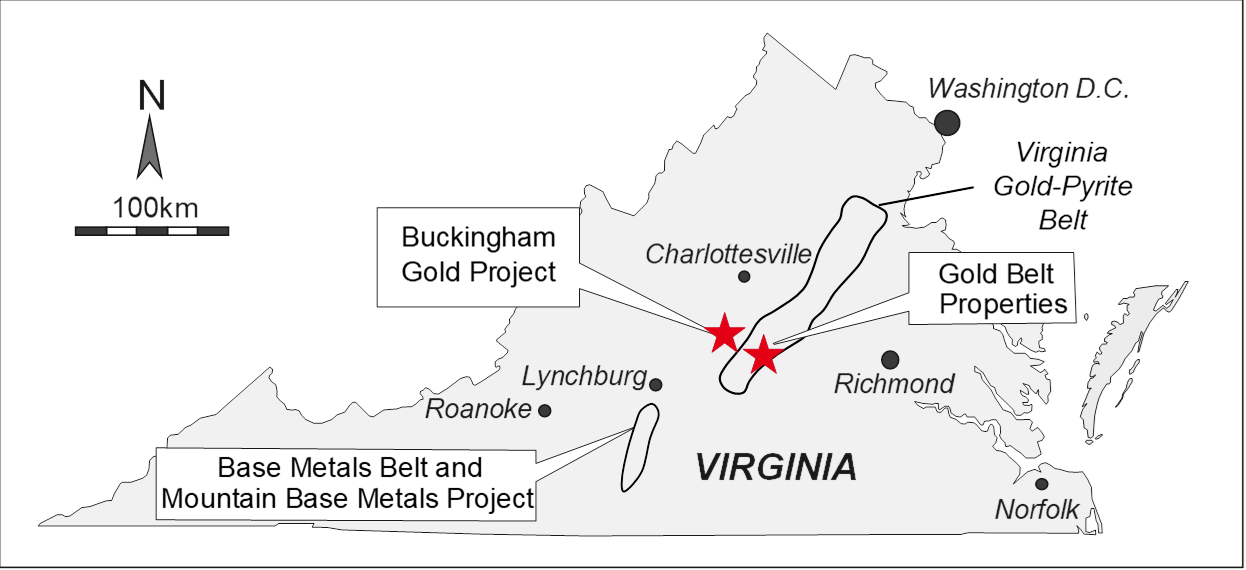

Virginia Overview

Investment Thesis: Exploration in Virginia

- Great geologic potential

- Historic gold production and recent gold discovery; underexplored base metals belt

- Scarcely explored since 1850: pre-modern exploration and mining methods

- Shallow workings, unexploited at depth due to lack of technology and capital

- Great jurisdiction

- United States: safe and secure

- Private forestry lands: resource-friendly

- No seasonality: drill year-round

- Experienced team

- Microcap stock with upside exposure

Near-term Catalyst:

Buckingham Gold Discovery

- High grade gold discovery

- Gold at surface (701 g/t or 20.4 ounces Au per short ton) and in drill holes

(e.g., 2.03m @ 35.61 g/t and 24.73 g/t over 3.57m incl. 62.51 g/t over 1.39m)**

- Gold at surface (701 g/t or 20.4 ounces Au per short ton) and in drill holes

- Open along strike and at depth

- Potential for size

- Ability to act quickly

- Drill-ready targets

- No seasonality: drill year-round

- Explore quickly, ramp up quickly, with no permitting lag

- Agreements on adjacent lands forthcoming

**widths indicated are core length

Brownfields Virginia Gold Belt Properties

- Drill ready targets on past producer properties (proposed Q4 2021/ Q1 2022 drill program)

- No seasonality: drill year-round

- Continued evaluation of historic gold properties in belt: prospecting, panning. , soil sampling

Mountain Base Metals Project

- Currently drilling highest priority target (TZ-3), an airborne EM conductor anomaly 2.2km in strike length

- Sphalerite and chalcopyrite mineralization encountered in every hole; assays pending

- Expanded target: agreements on adjacent lands forthcoming

Virginia Investment Highlights

- Gold and base metals focused exploration in US.

- Near-term discovery potential.

- A target - and data-rich, under-explored project with drill-ready targets and access to a very large ground position on private land.

- Significant gold and base metals drill intercepts in new discovery with limited follow-up.

- Year-round access and well-developed infrastructure allow for steady news flow.

- "Fee simple" private land jurisdiction with no permitting required for exploration or drilling

- Exposure to quality base metals projects.

Gold in Virginia

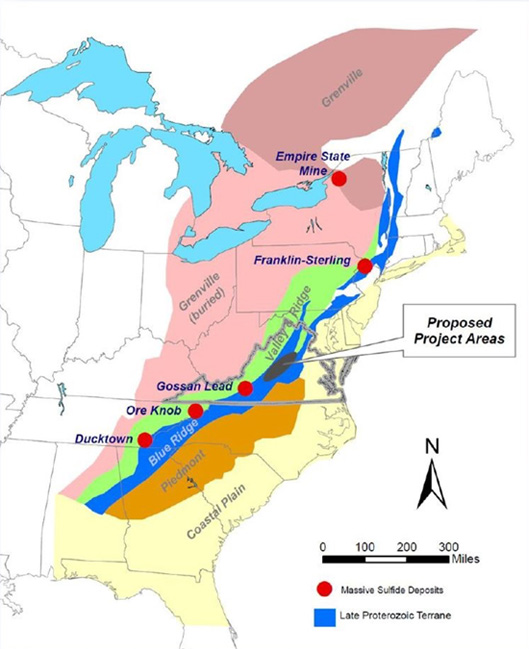

The gold-bearing system at the Buckingham Project is hosted within a package of likely late Precambrian or early Cambrian-age sediments, including greywackes with minor quartz-arenites (phyllite, schist and quartzites), within the Appalachian orogenic belt, hosting past producing mines, current gold mines and advanced gold exploration plays in a belt from Georgia, the Carolinas, Virginia, Nova Scotia and through to Newfoundland. This region is the site of the historically prolific Virginia Gold-Pyrite Belt which hosted a reported 250 gold mines that were in production prior to the California gold rush of 1849 but has seen little recent mineral exploration. Gold production has also occurred to the south in the Carolina Slate Belt, notably at OceanaGold’s Haile Mine located in South Carolina with commercial production commencing in 2017 and slated to produce up to 150,000 ounces of gold per year.

Exploration History of the Area

Geological investigations by BHP Minerals (BHP) and joint venture partner, Cominco American Inc (CAI) in 1995 identified a geologic terrane in the Lynchburg area as a prospective belt with largely unrecognized potential for sediment-hosted base metal massive sulfide and/or gold deposits. Regional geological mapping and geochemical sampling confirmed the potential and led to land acquisition, detailed sampling, limited surface diamond drilling and an airborne geophysical survey. Exploration by BHP and CAI ended in 2000 and the total expenditures by BHP and CAI are estimated at US $4.5M.

Don Taylor, through privately-held Jack’s Fork Exploration Inc. (JFE), continued with exploration, constructing a database of the available historic geological, geochemical and geophysical data and conducted significant additional work on the ground. JFE’s total expenditures was approximately US$3M, with work including reconnaissance and project-area geological work including mapping, rock and soil sampling, and ground geophysics since 2008.

Through the purchase of JFE), led by award-wining geologist Don Taylor, Aston Bay owns exclusive rights to an integrated geophysical, geochemical and geological dataset over the Blue Ridge Project area located in central Virginia, USA. The Blue Ridge Project is located within a copper-lead-zinc-gold-silver (Cu-Pb-Zn-Au-Ag) mineralized sedimentary and volcanic belt prospective for sedimentary exhalative (SEDEX) or Broken Hill (BHT) type deposits. Correlative rock units in adjacent states of North Carolina and Tennessee host historic mineralized deposits including Ducktown, Ore Knob, Gossan Lead and Haile.

Don Taylor, CEO of JFE, has joined the Aston Bay team in the position of Technical Advisor and will be directing exploration for the Blue Ridge Project. Mr. Taylor was COO of Arizona Mining Inc. and the 2018 Thayer Lindsley Award winner for his discovery of the Taylor Pb-Zn-Ag Deposit in Arizona.

The comprehensive Blue Ridge Project dataset includes:

- Airborne EM/Mag survey covering approximately 50km x 100km (500,000 hectares or over 1.2 million acres).

- Regional stream sediment survey coincident to the AEM survey, including:

- Traditional -80 mesh survey samples analyzed for 31 elements, and

- Heavy mineral concentrate sampling identifying specific minerals of interest

- Multi-element soil grids over select targets

- Drill hole database:

- Assay data from multiple historical drill holes at area gold prospects

- Archival drill core and multi-element geochemical data from 20 diamond drill holes at area Cu-Zn-Pb prospects

The Blue Ridge Project has numerous strengths that will be accretive to Aston Bay, including:

- Near term discovery potential for both base and precious metals

- A target- and data-rich, under-explored project with drill-ready targets and access to a very large land position

- Significant recent and historical drill intercepts with limited follow-up

- Numerous base metal and gold prospects identified through geophysics, geology & geochemistry

- Year-round access and well-developed infrastructure allow for steady news flow

- Private land leases in advanced stages of negotiation, and

- Well-established mining law and permitting process

Geology and Mineralization

Past exploration efforts were focused on the discovery of sedimentary-hosted Cu-Zn-Pb-Ag deposits of the sedimentary exhalative (SEDEX) or Broken Hill (BHT) type.

Historic exploration for such deposits has been limited due to rare bedrock exposure (typically ≤1%) and extensive saprolite development. Modern exploration occurred only in the middle to late 1990’s when BHP and later joint venture partner CAI, identified the south-central section of the Blue Ridge terrane as permissive to host significant massive sulfide deposits of these types.

BHP and CAI drilled 11 core holes on area properties; nine of the 11 historic holes intersected notable amounts of disseminated, vein-type, and massive base metal mineralization within marbles and schists over short sections. Significant highlights from that drilling include;

- 2.77% Cu, 0.94% Zn, 0.54% Pb, and 8.2 ppm Ag over 16.4 feet, and

- 1.17% Cu, 5.23% Zn, 0.90% Pb, and 21.3 ppm Ag over 7.4 feet in separate holes.

The historic drilling results indicate that the stratigraphy in the project area contains mineralization consistent with the SEDEX/BHT type and the potential to host significant and economic Cu-Zn-Pb-Ag deposits of this type.

In addition to base metals, Aston Bay is following up on the precious metals potential in the area demonstrated by the historic gold mining in the Virginia Gold Pyrite Belt as well as Aston Bay’s recent discovery of high-grade, near-surface gold in the Buckingham Vein.