Projects

Nunavut Overview

Property Overview

Aston Bay is partnered with ASX-listed American West Metals (ASX: AW1) in an 80/20 (AW1/BAY) unincorporated joint venture. Aston Bay is free carried for all expenditures up to bankable feasibility study.

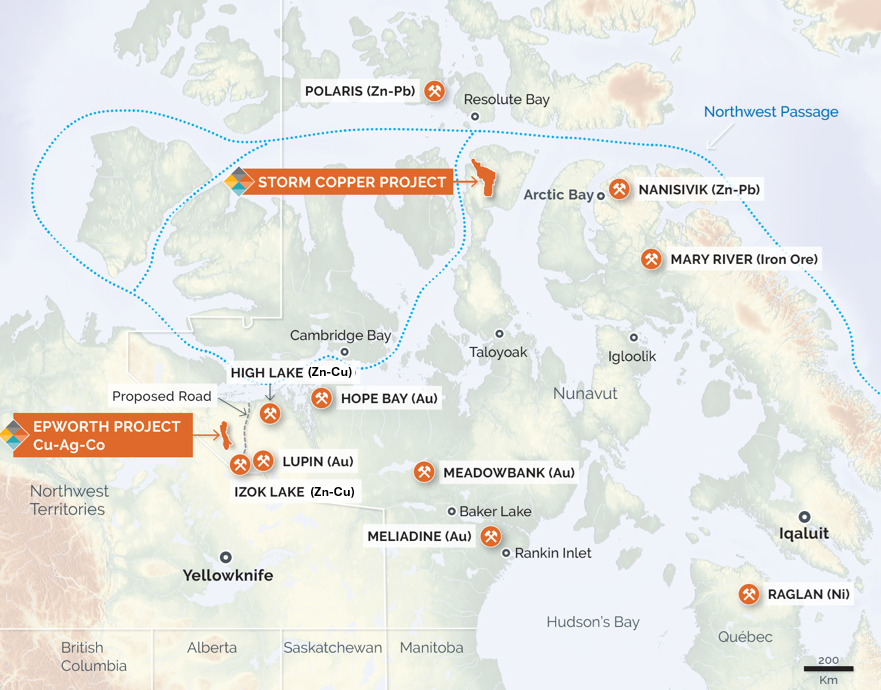

The property is located 112 km south of the community of Resolute Bay, Nunavut on western Somerset Island. The property is adjacent to tidewater on Aston Bay and comprises 12 prospecting permits and 118 contiguous mineral claims, which comprises of Storm Copper and Seal Zinc, covering an area of approximately 541,796 acres (219,257 hectares). The property has good access to shipping lanes, and the landscape provides favorable conditions for development of roads and a protected deep-water port. Exploration is supported through excellent infrastructure in the nearby hamlet of Resolute Bay.

Historical exploration around the Nunavut Property has defined two distinct styles of mineralization, each associated with its own specific stratigraphic horizon. The stratabound Seal Zinc (“Zn”) deposit occurs in Early to Middle Ordovician Ship Point Formation rocks. The stratigraphic and structurally controlled Storm Copper (“Cu”) showings occur at least 800 metres (“m”) higher in the stratigraphic column in the Late Ordovician to Late Silurian Allen Bay Formation (Cook and Moreton, 2000).

Mineralization at the Seal Zn deposit is primarily hosted within a quartz arenite unit with interbedded dolostone and sandy dolostone of the Ordovician Ship Point Formation. Mineralization at the Storm Cu showings is epigenetic, carbonate-hosted and lies within an intracratonic rift basin that has been modified by folding and faulting. The mineralization is spatially associated with the north and south boundary faults of the Central Graben. This structure is interpreted as a pull-apart basin developed as a result of translational movement along basement-rooted faults. The basal Aston Formation red beds are thought to be a plausible source of metals for the mineralization at both the Seal Zn and Storm Cu showings.

The area has been an exploration target since 1960 when mineralization was first discovered while conducting oil and gas exploration in the region. From early 1964 until 2007, Teck Resources Ltd., formerly Cominco Ltd. (“Teck”), was actively conducting exploration within Aston Bay’s property. Commander Resources Ltd. acquired prospecting permits in the area after the land package held by Teck lapsed in 2007.

Located in the Qikiqtani Region

The Aston Bay Property is located within the Qikiqtani Region of Nunavut. Qikiqtaaluk is the traditional Inuktitut name for Baffin Island. Home to 14,000 Inuit, The Qikiqtani (Baffin) Region includes 13 communities from Grise Fiord in the High Arctic to Sanikiluaq (Belcher Island) in the south and also hosts the Nunavut capital Iqaluit. Aston Bay’s exploration activities are operated from the nearby hamlet of Resolute (Qausuittuq).

Aston Bay Option Agreement with American West Metals Limited

Aston Bay entered into an Option Agreement dated March 9, 2021 (the “Option Agreement”) with American West Metals Limited and its wholly-owned subsidiary, Tornado Metals Ltd. (collectively, “American West”) pursuant to which American West was granted an option (the “Option”) to earn an 80% undivided interest in the Project by spending a minimum of CAD$10 million on qualifying exploration expenditures (“Expenditures”). The parties amended and restated the Option Agreement as of February 27, 2023 to facilitate American West potentially financing the Expenditures through flow-through shares but did not change the commercial agreement between the parties.

The Expenditures were completed during the 2023 drilling program and American West exercised the Option in accordance with the terms of the Option Agreement, as amended. American West and Aston Bay will form an 80/20 unincorporated joint venture and enter into a joint venture agreement. Under such agreement, Aston Bay shall have a free carried interest until American West has made a decision to mine upon completion of a bankable feasibility study, meaning American West will be solely responsible for funding the joint venture until such decision is made. After such decision is made, Aston Bay will be diluted in the event it does not elect to contribute its proportionate share and its interest in the Project will be converted into a 2% net smelter returns royalty if its interest is diluted to below 10%.

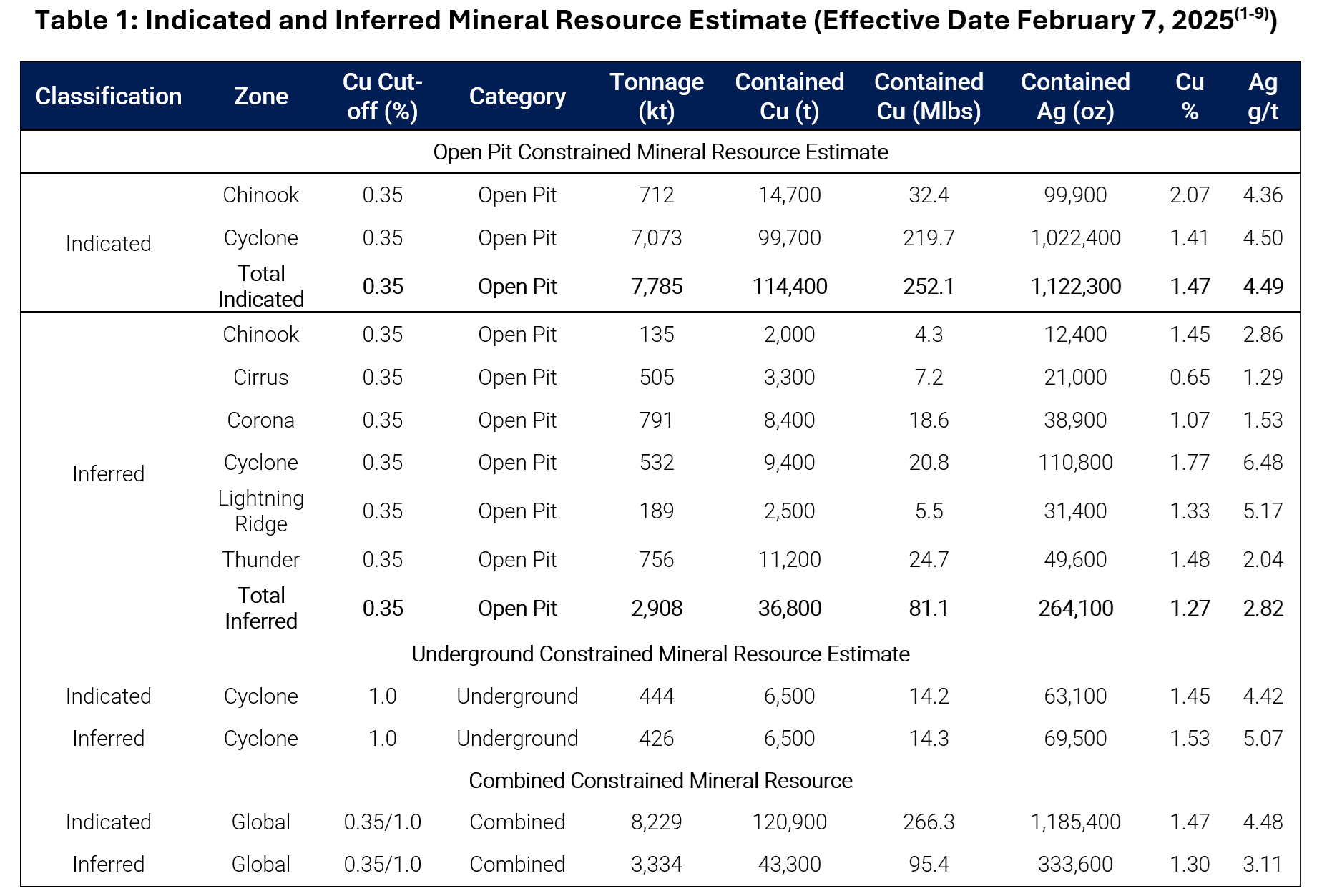

Initial Mineral Resource Estimate

As of February 7, 2025, the near-surface mineralization (<120 metres depth) at Storm includes:

Indicated Mineral Resources:

- 8.2 million tonnes at 1.47% copper (Cu) and 4.5 g/t silver (Ag)

- Containing 266.3 million pounds (121,000 tonnes) of copper

- Containing 1.185 million ounces of silver

Inferred Mineral Resources:

- 3.3 million tonnes at 1.30% Cu and 3.1 g/t Ag

- Containing 95.4 million pounds (43,000 tonnes) of copper

- Containing 333,600 ounces of silver

Key Features

- Near-surface mineralization: Less than 120 metres depth

- Open-pit potential: Over 90% of contained metal accessible by open-pit mining

- High-quality mineralization: 100% fresh, chalcocite-dominant copper sulphide

- Excellent metallurgy: Testwork confirms strong beneficiation potential, including sorting

Growth Opportunities

- All six deposits (Cyclone, Chinook, Corona, Cirrus, Lightning Ridge, and Thunder) remain open for expansion

- Cyclone Deeps discovery (2024) with 1.2% Cu over 10 m from 311 m depth

- New high-grade copper discoveries: The Gap, Squall, and Hailstorm

- Extensive exploration potential along 110 km copper belt and at depth

Seal Zinc-Silver Deposit

- The project also includes the Seal Zinc Deposit, located 28 km northwest of the Storm Copper deposits

- Seal Zinc Deposit Inferred Mineral Resources: 1.006 million tonnes at 10.24% zinc (Zn) and 46.5 g/t Ag

Note: Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.