News

Aston Bay Drills 62.51 g/t Au over 1.39m and 35.61 g/t Au over 2.03m at its Buckingham Gold Property in Virginia, USA

Aston Bay Holdings Ltd. (TSX-V: BAY; OTCQB: ATBHF) (“Aston Bay” or the “Company”) is pleased to announce the initial results of its recently completed drill program at the Buckingham Gold Project located in central Virginia, USA. Six large diameter (HQ) diamond drill holes totaling 878 metres (m) were completed with partial results received to date for four of these holes.

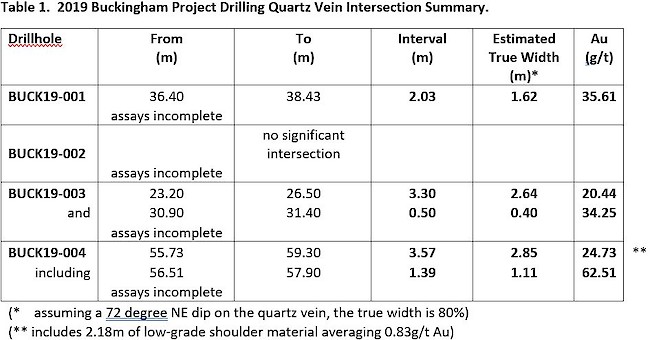

Three of these four holes intersected significant near-surface gold mineralization, including 35.61 g/t Au over 2.03m in hole BUCK19-001, 20.44 g/t over 3.30m and 34.25g/t over 0.5m in hole BUCK19-003, and in hole BUCK19-004 24.73 g/t over 3.57m including 62.51 g/t over 1.39m. These results are presented in Table 1. Based upon multiple vein intersections, the estimated true width is 80% of the core interval. The assay results are based upon one kilogram pulp metallic screen analyses from HQ core for the mineralized intervals.

The current drilling targeted an area of boulders and sub-crop of quartz veining in which visible gold had been identified and sampled, followed by limited but successful drilling completed by a previous owner. That previous program consisted of three holes on the Buckingham Property, all of which intersected significant gold, including 15.57 g/t Au over 4.1m and 11.69 g/t Au over 3.1m. In addition to gold-bearing quartz veining, the previous drilling intersected a zone of sericite-pyrite alteration yielding 0.4 g/t Au over 24m (all historic intercepts are core intervals, i.e., not true width; see March 4, 2019 Aston Bay press release).

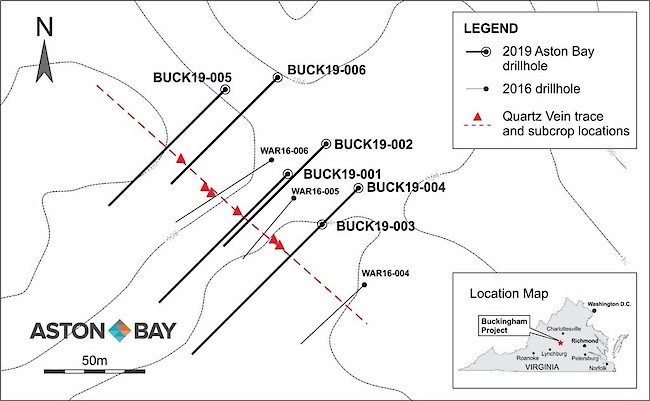

The current drill program was designed to test along strike and down dip along the targeted northwest-southeast trending vein system as well as test for zones of gold-bearing alteration. Three of the six drill holes intersected quartz veining; results from all intercepted quartz-veined intervals are reported here. Several zones of moderate to strong sericite-pyrite alteration were also intersected in several holes from the current drilling; assay results from these zones are pending.

The vein system is hosted within a package of likely Cambrian-age sediments, including greywackes with minor quartz-arenites (phyllite, schist and quartzites), within the Appalachian orogenic belt. This region is the site of the historically prolific Pyrite Belt which hosted a reported 250 gold mines that were in production prior to the California gold rush of 1849 but has seen little recent mineral exploration. Gold production has also occurred to the south in the Carolina Slate Belt, notably at Oceana Gold’s Haile Mine located in South Carolina with commercial production commencing in 2017 and slated to produce up to 150,000 ounces of gold per year.

Thomas Ullrich, the Company’s CEO commented: “The high grade gold mineralization that occurs within the quartz veining is a very attractive target, especially as it is present at the surface and near-surface. In addition, we are very interested in the alteration zones that also have the potential to host disseminated-type gold mineralization, similar to some economic deposits elsewhere in the region. This outcropping mineralized zone sits within a much larger gold-in-soil anomaly, suggesting the potential for a much larger system concealed under cover. From this data, we look forward to designing a comprehensive exploration program for both vein- and disseminated-type gold mineralization, which will include geochemical and geophysical surveys, to identify additional high priority drill targets along strike and downdip.”

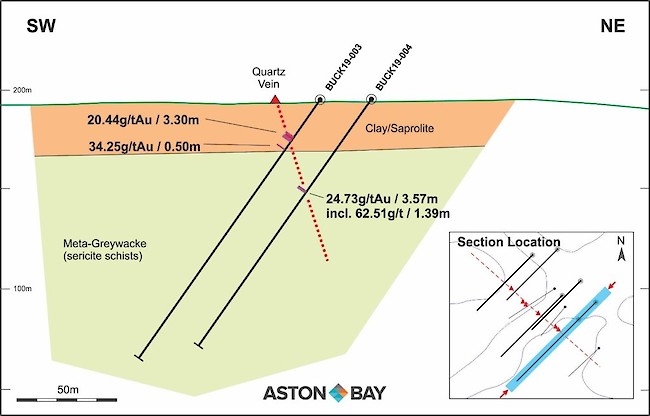

The following is a summary of the intervals assayed to date from the 2019 drill program. At present, sample assaying is approximately 20% complete with all of the quartz veined intervals now completed. Samples from the program were shipped for analysis at the ALS Laboratory in Reno, Nevada. Samples of quartz vein and several adjacent “shoulder” samples were assayed by the metallic screen technique, while the remainder of the samples received a standard 30g Fire Assay with an AA (Atomic Absorption) finish. Proper chain of custody and all quality control protocols were maintained. The drill hole locations are illustrated in Figure 1; a cross-section through holes BUCK19-003 and-004 is presented in Figure 2.

BUCK19-001:

Hole BUCK19-001 was collared approximately 25m from the central portion of the quartz vein subcrop exposures and was drilled to the southwest. The massive white quartz vein contained several clusters of small visible gold grains, along with minor chalcopyrite, pyrite, sphalerite, galena and trace pyrrhotite. The vein was intersected at the base of the weathering profile (saprolite) at the transition into un-weathered phyllite. The vein assayed 35.61g/t Au (1.04oz/ton Au) over 2.03m core length. The apparent dip of the vein is 72o to the northeast, yielding an estimated true thickness of approximately 1.62m.

BUCK19-003:

Holes BUCK19-003 and BUCK19-004 were drilled parallel to holes BUCK19-001 and BUCK19-002 on a section approximately 25m to the southeast. BUCK19-003 intersected two quartz vein intervals. The upper (main) quartz vein interval most closely resembled the vein intersected in BUCK19-001 with sulfide mineralization and abundant fine visible gold grains, yielding 20.44g/t (0.60opt) over a core interval of 3.30m between 23.20m and 26.50m. This represents an estimated true thickness of approximately 2.64m. A second thin quartz vein interval was intersected between 30.90m and 31.40m (0.50m interval, 0.40m estimated true thickness) that yielded 34.25g/t (~1.00opt) Au. Three samples of greywacke between the two vein intervals assayed between 0.18 and 0.23g/t Au. Including these samples, the interval with both veins (23.20-31.40m) averaged 10.42g/t (0.30opt) Au over an 8.2m core interval (~6.55m true thickness). The lower quartz vein interval sits adjacent to a gouge zone which may be part of a structural offset zone.

BUCK19-004:

BUCK19-004 was an approximately 25m step-back undercutting hole 3. Similar to BUCK19-003, BUCK19-004 intersected two (2) quartz vein intervals, but located closer together. Both intervals are similar in character to BUCK19-001, containing visible gold. The upper interval yielded 41.90g/t (1.22opt) Au over 0.85m core length (56.51m-57.36), while the lower vein interval yielded 146.0g/t (4.26opt) Au over 0.35m core length (57.55m-57.90m). The phyllite between the vein intervals contained anomalous gold (0.18g/t Au) over the 0.9m core length. Including this sample, the interval with both veins (from 56.51m to 57.90m) averaged 62.51g/t (1.82opt) Au over a core interval of 1.39m, representing a true thickness of approximately 1.11m. In addition, there are low-grade (anomalous) gold intervals assaying up to 0.98g/t Au in several ‘shoulder samples’ adjacent to the is vein interval. Including these shoulder samples, the zone of quartz vein and adjacent pyrite mineralized phyllites averaged 24.73g/t (0.72opt) Au over a core interval of 3.57m between 55.73m and 59.30m, representing a true thickness of approximately 2.85m.

BUCK19-002, BUCK19-005 and BUCK19-006:

No significant quartz vein was intersected in these holes. Several fault zones were intersected throughout these holes suggesting the vein may have been fault offset in this area. Zones sericite-pyrite alteration are clearly present, however, and all holes, including the non-quartz veined portions of BUCK19-001, -003 and -004, will be assayed in their entirety. These results will be presented in an upcoming release when results are received.

QUALIFIED PERSON

As per National Instrument 43-101 Standards of Disclosure for Mineral Projects, Andrew Turner, P.Geol., a consultant to Aston Bay, is the Qualified Person for the Company and has prepared, validated and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting its exploration activities.”

ABOUT ASTON BAY HOLDINGS LTD.

Aston Bay is a publicly traded mineral exploration company exploring for large, high-grade, copper, zinc and precious metal deposits in Nunavut, Canada and Virginia, USA. The Company is led by CEO Thomas Ullrich with exploration directed by Chief Geologist Dr. David Broughton, the award-winning co-discoverer of Kamoa-Kakula and Flatreef, in conjunction with the Company’s advisor, Don Taylor, the 2018 Thayer Lindsley Award winner for his discovery of the Taylor Pb-Zn-Ag Deposit in Arizona.

The Company is 100% owner of the 1,024,345-acres (414,537-hectares) Aston Bay Property located on western Somerset Island, Nunavut, which neighbours Teck’s profitable, past-producing Polaris (Pb-Zn) Mine just 200km to the north. The Aston Bay Property hosts the Storm Copper Project and the Seal Zinc Deposit with drill-confirmed presence of sediment-hosted copper and zinc mineralization.

The Company has also acquired the exclusive rights to an integrated dataset over certain prospective private lands at the Blue Ridge Project, located in central Virginia. These lands are located within a copper-lead-zinc-gold-silver mineralized belt, prospective for sedimentary exhalative (SEDEX) and Broken Hill (BHT) type base metal deposits, as well as Carolina slate belt gold deposits. Don Taylor, who led the predecessor company to Blue Ridge and assembled the dataset, has joined the Company’s Advisory Board and will be directing the Company’s exploration activities for the Blue Ridge Project.

The Company’s public disclosure documents are available on www.sedar.com.

FORWARD-LOOKING STATEMENTS

Statements made in this press release, including those regarding the completion of the acquisition, management objectives, forecasts, estimates, expectations, or predictions of the future may constitute “forward-looking statement”, which can be identified by the use of conditional or future tenses or by the use of such verbs as “believe”, “expect”, “may”, “will”, “should”, “estimate”, “anticipate”, “project”, “plan”, and words of similar import, including variations thereof and negative forms. This press release contains forward-looking statements that reflect, as of the date of this press release, Aston Bay’s expectations, estimates and projections about its operations, the mining industry and the economic environment in which it operates. Statements in this press release that are not supported by historical fact are forward-looking statements, meaning they involve risk, uncertainty and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. Although Aston Bay believes that the assumptions inherent in the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which apply only at the time of writing of this press release. Aston Bay disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by securities legislation. We seek safe harbour.

Neither TSX Venture Exchange nor its regulation services provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

FOR ADDITIONAL INFORMATION CONTACT:

Thomas Ullrich, Chief Executive Officer

thomas.ullrich@astonbayholdings.com

Telephone: (416) 456-3516

Sofia Harquail, IR and Corporate Development

sofia.harquail@astonbayholdings.com

Telephone: (647) 821-1337